Tokenizing Real Estate: The Future of Property Investment

Enhance your real estate investment potential with tokenization, tapping into a $3.69 trillion market.

With the real estate market valued at $3.69 trillion and a tokenized market cap of only $200 million, the potential for growth is staggering. These figures underscore the transformative power of real estate tokenization, and the opportunities it presents for investors worldwide.

Overcoming Challenges with Blockchain Tokenization

The real estate market, despite its immense global value, is riddled with multifaceted challenges that hinder its potential to access a wider pool of investors. Central to these challenges is the inherent illiquidity of real estate, which often ties up vast sums of capital, making it an unattainable investment option for smaller players. The traditionally high cost of entry, amplified by the lack of feasible fractionalization solutions, has perpetuated a market that can feel exclusive and out of reach for most people. Moreover, legal hurdles surrounding real estate transactions, such as title disputes and zoning restrictions, make investing in real estate a complicated and often expensive endeavor.

In recent years, blockchain technology has emerged as a revolutionary force in the real estate business, offering compelling solutions to the sector's longstanding challenges. Its decentralized nature, combined with secure smart contracts, makes it an ideal fit for an industry in need of enhancing transparency, efficiency, liquidity, and access. A prime example of the innovative potential of blockchain is Real Estate Tokenization, one of the most talked-about phenomena in the real estate business.

What are the Benefits?

Real estate tokenization represents a fundamental shift in the industry, offering a host of benefits that redefine traditional investment models. One of its primary advantages is enhanced liquidity, allowing investors to trade smaller portions of properties. This fractional ownership model not only boosts liquidity but also reduces barriers to entry, democratizing access to real estate investments. Moreover, tokenization enables investors to diversify their portfolios across various assets, mitigating risks and optimizing investment strategies. By leveraging blockchain technology, transactions become streamlined and automated, cutting administrative costs and enhancing operational efficiency. Additionally, real estate tokenization fosters global accessibility, enabling investors worldwide to access diverse markets and opportunities.

How Does it Work?

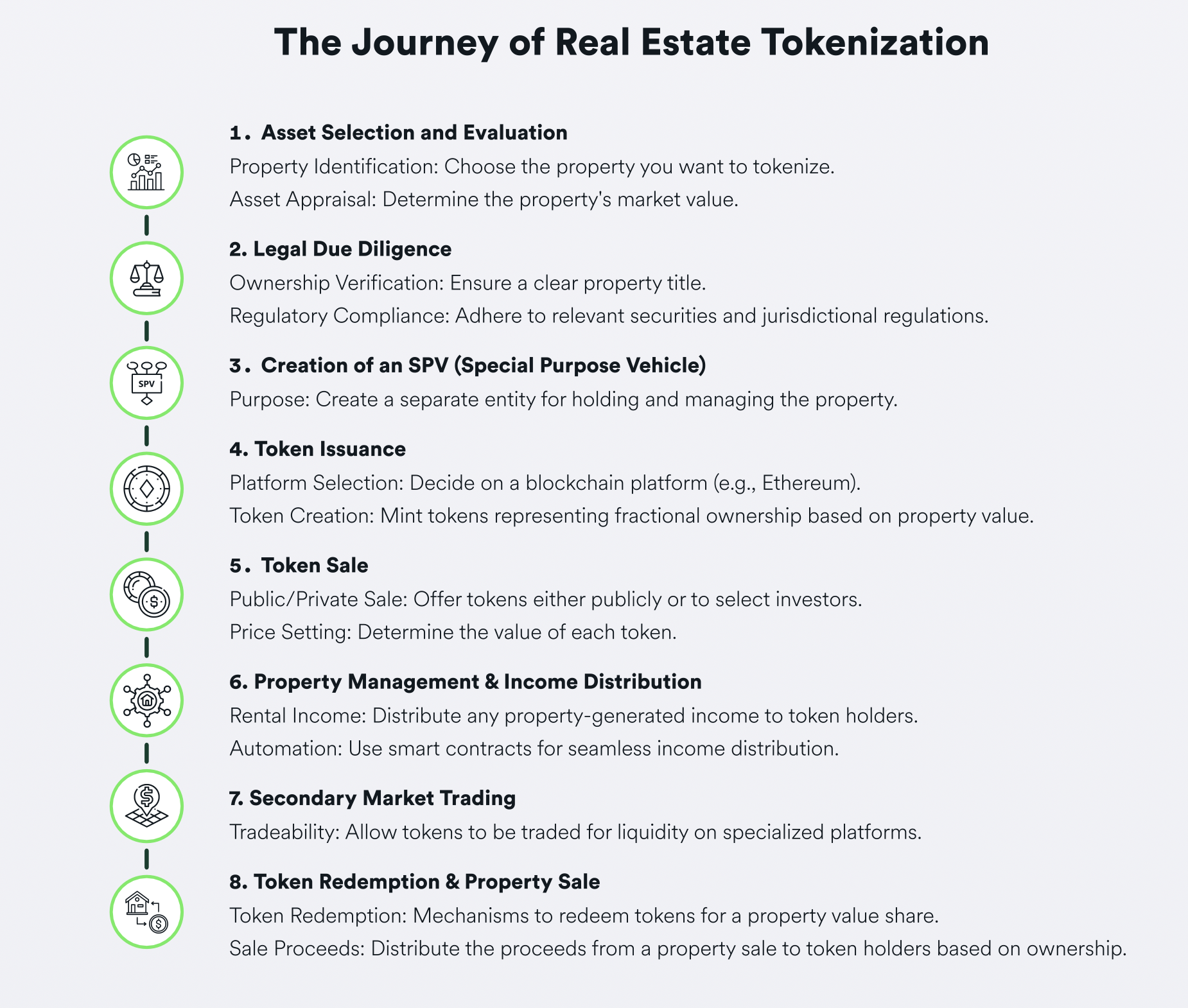

Real estate tokenization involves turning the ownership rights of real estate or associated Special Purpose Vehicles (SPVs) into digital tokens on a blockchain. This approach addresses common industry challenges by enhancing liquidity, simplifying bookkeeping, facilitating cross-border settlements, and offering fractional ownership. With properties or SPVs represented on the blockchain via tokens, the real estate market stands to gain unparalleled accessibility, efficiency, and inclusivity, marking a pivotal shift towards a more modern and innovative approach.

Real estate tokenization is rapidly gaining traction across the globe. Several successful implementations have demonstrated its transformative potential in unlocking new avenues for investors and streamlining real estate transactions. For instance, platforms like RealtyMogul and Harbor have facilitated the tokenization of real estate assets, allowing investors to participate in property ownership with smaller capital contributions. These platforms utilize blockchain technology to fractionalize ownership and enable seamless transactions, opening up opportunities for a broader range of investors.

Looking Ahead: The Future of Real Estate Tokenization

As real estate tokenization continues to evolve, the possibilities for its application continue to arise. Beyond simplifying investment processes and enhancing liquidity, tokenization has the potential to revolutionize real estate financing, crowdfunding, and asset management. Moreover, the emergence of decentralized finance (DeFi) platforms built on blockchain technology could further democratize access to real estate investment opportunities, paving the way for a more inclusive and transparent market. In conclusion, real estate tokenization represents a paradigm shift in the way properties are bought, sold, and invested in. By leveraging blockchain technology, it offers transformative solutions to the traditional challenges plaguing the real estate market. As the adoption of real estate tokenization continues to expand, it is poised to reshape the future of real estate, unlocking new opportunities for investors and stakeholders across the globe.

Download Our Free Real Estate Tokenization E-Book!

Discover the Future of Real Estate Investment: Access Our Free E-book Today! Learn about the transformative power of Real Estate Tokenization and how blockchain technology is revolutionizing the industry. Get your free copy now!

About Aurora

Powered by its high-performance EVM, and fully trustless Rainbow Bridge, Aurora combines an Ethereum compatible experience with the modern blockchain performance of NEAR Protocol. Aurora provides an optimal environment for the creation of scalable, carbon-neutral, future-safe, and low-cost Web3 services, as well as the perfect tools to bring to life your Web3 initiatives. Try Aurora Cloud, our all-in-one blockchain solution for enterprises, and get your Web3 journey started!